Crypto News – Latest Cryptocurrency Breaking News

More stories

-

Kalshi wins in court to allow legal betting on US elections

Kalshi’s win opens the door for platforms such as Web3-based Polymarket, to enter legally into the market of election predictions. Election betting markets are gaining popularity despite concerns over ethics and possible manipulation. Supporters argue that they provide a more accurate gauge of public opinion than traditional polls. Polymarket has also gained traction by offering a bet pool to determine the identity of Satoshi Nakamoto, Bitcoin’s original creator. Global crypto adoption is on the rise and nearing 8 percent.

Kalshi Wins Court Battle

After a significant legal win, the derivatives exchange Kalshi has listed contracts that allow users to bet on US elections. Tarek Mnsour, the platform’s creator, posted on X on October 7 that traders can legally bet on election results, such as US presidential elections, state winnings, and margins of victory.

It is the first election predictions market in US history to be legal. This opens the door for new platforms to enter the market, such as Web3’s Polymarket.

The Commodity Futures Trading Commission reports that Kalshi self-certified over a dozen betting contracts on elections, and the regulator has approved them. The contracts, which are binary options, include wagers on political outcomes such as whether or not a specific candidate will become a nominee for a certain party, or whether that party will gain a Senate seat during a given year.

After Kalshi’s battle with the CFTC which had previously prohibited the platform to list political event contracts, the approval came after Kalshi’s legal fight. The CFTC had appealed this court decision, and wanted Kalshi to be unable to list these contracts. However, on October 2, the court ruled that Kalshi could indeed list the political event contracts.

Kalshi is still behind Polymarket despite this victory. Polymarket has become the leader in election betting. Polymarket had seen over $1 billion worth of bets placed on the US Presidential election in November, whereas Kalshi’s contracts saw a total volume of $775,000.

Presidential election odds volume (Source: Polymarket)

Some industry analysts claim that while the CFTC has concerns about the election prediction markets, they capture the public’s sentiment better than polls.

The Ethics of Election Betting Markets is a Growing Topic

The CFTC has proposed to ban election derivatives in May 2024. Some industry experts claim that, despite initial fears about manipulations, prediction markets are a more accurate measure of public sentiment.

Harry Crane, a Rutgers University professor, defended the markets recently by saying that they collect diverse data for a more accurate forecasting process than polls which measure only sentiment. He clarified, too, that the markets encourage participants to make predictions about who would win while polls are only a gauge of preference.

The victory of Kalshi in court has reignited debates on the future of prediction market in the US. However, offshore platforms such as Polymarket are already gaining a great deal of momentum. Polymarket may block US users but its election data is quite important and appears even on Bloomberg Terminal. CFTC chair Rostin Behram has however warned Polymarket that it could face enforcement action if its US footprint increases.

New accounts added to Polymarket every month (Source:Dune )

Cantrell dumas, from Better Markets is among those who are worried that betting markets of this size could be used to commercialize elections, and erode public confidence in democracy. The critics also claim that strict supervision is needed to prevent fears of manipulation of elections, particularly in the current climate of public distrust after allegations of fraud during 2020’s election.

Even with these worries, some people still believe prediction markets are beneficial to the public because they provide a more accurate and objective forecast for election results. The ethical implications of gambling on sensitive issues, such as elections and conflicts, are still in dispute.

Ethereum’s co-founder Vitalik Buterin addressed these concerns recently, and said that gambling becomes a problem when it encourages insider gains for harmful activities.

Polymarket Bets Satoshi Nakamoto’s Identity

These betting sites offer more than just elections. Polymarket listed Len Sassaman as an American computer science as the frontrunner to reveal Satoshi as Bitcoin’s founder in an HBO documentary. Cullen Hoback, a filmmaker, directed the documentary Money Electric: Bitcoin Mystery. The documentary is scheduled to air in October.

While neither Hoback or HBO has confirmed the identity of Nakamoto, social media teasers suggest that there may be an important revelation.

Satoshi, the man HBO will identify in its documentary (Source:Polymarket )

Since the HBO documentary’s announcement, a Polymarket trading pool asking, “Who will HBO document identify as Satoshi?” attracted an impressive amount of interest. As of October 4, it had already attracted $389,738 in total. Top suspects include Hal Finney Adam Back Craig Wright and Nick Szabo. On Oct. 7, Len Sassaman was the top-ranked candidate.

Sassaman died in 2011, at age 31, after a long battle with cancer. He was well-known for his contributions to the privacy-enhancing technology and Cypherpunk movements. Although there’s no evidence directly linking him to Bitcoin, in a post on Medium from 2023 it was speculated that he could be Nakamoto because of his experience with open-source advocacy.

The rules of the Polymarket Pool state that if Sassaman’s role is credited as being the main developer of Bitcoin in the film, then the market is likely to resolve “Yes”. If another person or group are identified or Sassaman has a joint responsibility, the pool will be resolved to “No.”

Crypto Adoption Globally Nears 8%

Crypto adoption is also gaining momentum, just as prediction markets have. According to MatrixPort, global crypto adoption has reached a significant milestone. Currently, 7.51% (or a quarter of) the population uses digital currencies. This report predicts this number could exceed 8% by the year 2025. It also suggests that cryptocurrency could soon move from being a niche to becoming a part of financial mainstream systems.

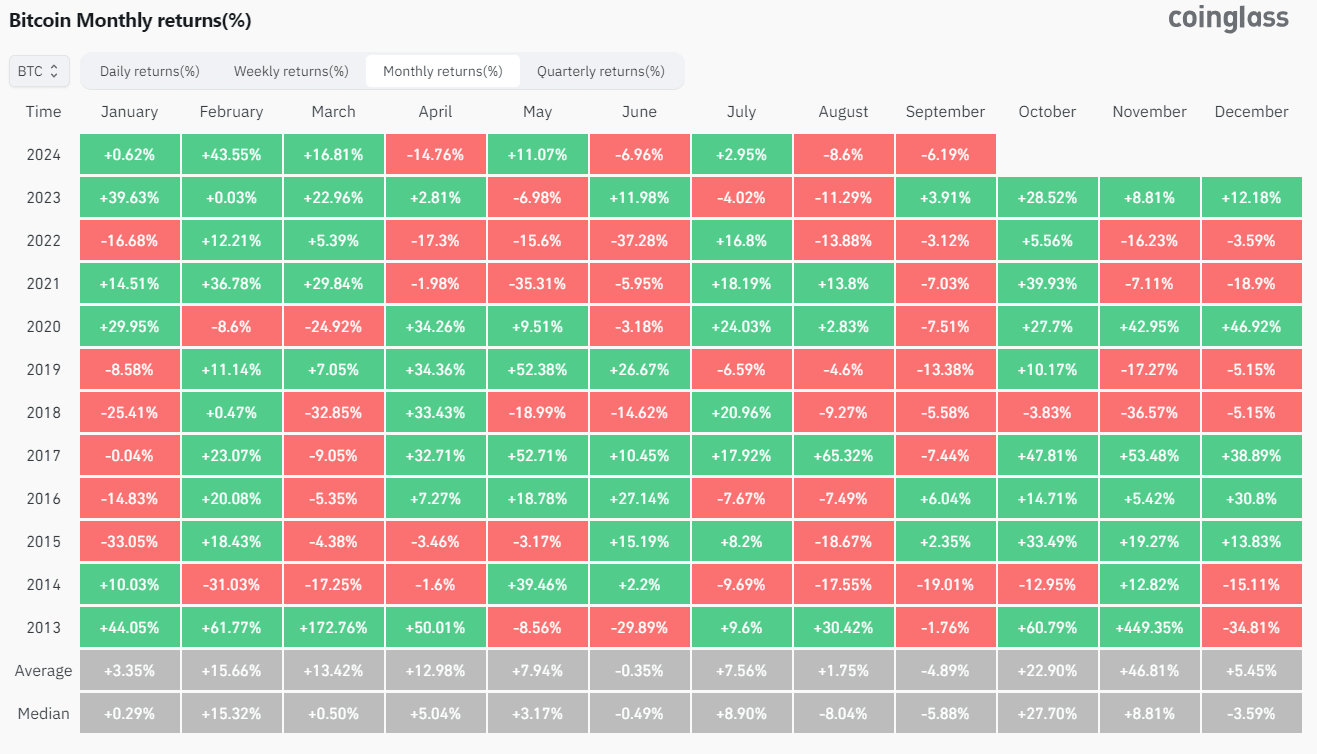

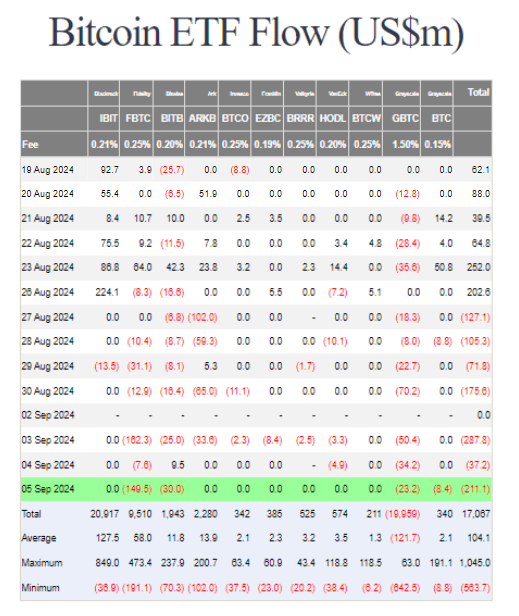

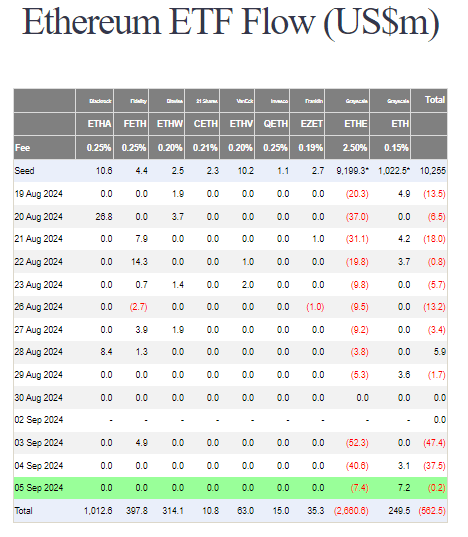

This growth is driven by institutional involvement. BlackRock, for example, has helped to build trust in the digital asset market. This is helping boost adoption. Markus Thielen of 10x Research explained that Bitcoin historically has driven the market whenever new products like Bitcoin Spot ETFs were introduced. The evolution of Bitcoin has been a key factor in the increase in institutional interest.

Bitcoin’s importance on the cryptocurrency market is also credited to its role as an economic store of value in times of uncertainty. Thielen noted that economic crises, such as the European Debt Crisis or increasing US debt, increased demand for Bitcoin. This positioned it to be a hedge in case of potential trade wars or recessions.

The report, despite its optimistic predictions, also highlighted several obstacles to a wider adoption of crypto. The risks are still serious. Regulatory obstacles, volatility in the market, and concerns about security, such as hacks and scams. Markets could be destabilized by institutional investors through massive sell-offs in times of macroeconomic changes.

-

Mynaswap: Revolutionizing Decentralized Trading Platforms

You Can Find It In This Article

MynaSwap has changed the way that collectors interact with physical objects. The platform allows users to trade collectibles such as sports cards by minting digital versions of them. The real-time trades are possible, but the fees charged by traditional markets are lower.

MynaSwap, founded by collectors themselves, prioritizes the user experience. It aims to provide a secure environment where collectibles can be traded. It is a great option for novices and experts alike, as it focuses on speed and authentication.

Mynaswap Overview

Mynaswap, an innovative trading platform for physical collectibles. The platform offers real-time trading and features to enhance collectors’ experience.

The Key Features

Mynaswap is unique in several ways:

-

Real Time Trading Users are able to trade collectibles immediately, keeping up with the market demand.

-

Multiple Currency Options The platform allows users to choose between digital currencies and fiat currency.

-

Secured Storage : Mynaswap provides custodial and secure storage solutions for physical objects.

-

Easy-to-Use Interface The platform has been designed for both beginners and more experienced collectors.

-

Asset Redeem Users are able to redeem digital items into tangible forms. This bridges the gap between collectibles digital and physical products.

Mynaswap is a complete tool for collectors.

Mynaswap and the Ecosystem

Mynaswap is a key player in the collectibles trade ecosystem, as it links collectors, curators and consumers.

Users can trade collectibles in digital form, increasing their value. The platform supports a variety of collectibles, such as sports cards and sneakers.

Mynaswap is competing with other platforms such as Collectable, but it still has a distinct advantage by focusing only on real-time payments.

Setting Up a Mynaswap Account

Mynaswap’s account creation is an easy process, which ensures both security and ease of access. The user will have to set up an effective authentication measure and follow certain steps in order to create their account.

Account Creation Process

Users must first visit Mynaswap’s website or mobile app. They will be able to open a new Mynaswap account.

-

Sign Up Form : The user must enter their email, username and password.

-

Requirements for Passwords It is important to select a password with uppercase, lowercase, numbers and special characters. It increases security.

-

Verification of Email After entering the required information, you will be sent an email asking for your address. To activate your account, you must click the link provided in the confirmation email.

-

Setup Profile Once your account has been verified, you can login and finish creating your profile. You may add additional details if needed.

The account will be ready to use once the process is complete.

Myna Sign-Up from

Authentication measures

Mynaswap is committed to account security. Authentication measures must be enabled after account creation.

-

Two Factor Authentication (TFA) : The users are encouraged to enable 2FA. It requires an additional verification, which is usually done through a mobile application.

-

Update passwords It is important to update your passwords regularly. This helps protect your personal data from unauthorised access.

-

Mynaswap sends notifications to users when there are unusual activities on their account. Users are encouraged to be vigilant and alert any suspicious activity.

This authentication provides an additional layer of security. These guidelines will help users to trade collectibles safely on Mynaswap.

MynaSwap Security

MynaSwap has several features that ensure the safety of your account and adheres to strict security protocol to protect transactions.

How to Protect Your Account

MynaSwap urges its users to be proactive in securing their accounts. It all starts by creating a password that’s difficult to guess. The passwords must include uppercase, lowercase, special characters, numbers and a mixture of these.

The users are encouraged to activate two-factor verification (2FA). It adds an additional layer of protection by requiring an extra form of verification such as a code from an authentication app or a text. MynaSwap also recommends regularly updating your passwords, and not using the same password on multiple websites.

Security protocols

MynaSwap uses advanced security protocols in order to safeguard user assets and data. Secure login procedures with encrypted connections are used for each account. Personal and financial data remains private.

In addition, MynaSwap ensures that all physical items sent for authentication are stored in a high-security, temperature-controlled vault. Collectibles are protected from damage or theft. This platform uses cutting-edge technology for counterfeit detection to verify items.

Mynaswap Interface

Mynaswap has a friendly interface designed to help collectors trade items efficiently.

Navigation of the Dashboard

Dashboard is the hub of Mynaswap. The dashboard is intuitive and allows users to easily access the different features.

The Key Features

-

User profile: Shows information about the account and transactions.

-

Market: Displays collectibles that are available for trading.

-

Notifications : Informs the user about new updates, trades and other information.

The user can filter the collectibles based on their category. For example, they could choose to only see sneakers or cards of sports. It makes it easier to find the items they want, and therefore more efficient. It is easy to navigate, even for newbies.

Trade Execution

Mynaswap’s trade execution is designed to be fast and simple. With just a couple of clicks, users can exchange their items in physical form for tokens.

-

Selecting items: The user selects the items he/she wants to exchange from his/her collection.

-

The Minting Process is the process of converting physical products into digital assets.

-

Trade confirmation: The transaction will be confirmed immediately if both parties have agreed.

The process allows for collectors to transact in real-time without having the actual physical items. This process increases security and efficiency while making trading easier. Mynaswap is a global leader in collecting due to the integration of features that allow for real-time trades.

Mynaswap Trading

MynaSwap is a trading platform that allows you to trade physical collectibles efficiently and in an efficient manner. The platform allows users to transact in real time, making it seamless for all collectors.

Available Collectables

MynaSwap lets users trade collectibles. Platform supports both fiat and digital currencies. The platform offers flexibility to users, allowing them to choose the trading methods they prefer.

Common collectibles include:

-

Collectibles Shoes

-

Watches for Luxury Lifestyle

-

Sports Memorabilia

The users can convert their assets easily into digital tokens. The process preserves collectibles’ value and allows for quick, efficient trading.

Charts and Tools for Trading

MynaSwap provides a number of tools that enhance trading. Real-time analytics and data allows users to make better decisions based on real-time information.

Platform includes:

-

Charts of the Market: Visualize trends and trading volumes.

-

Alerts : Configure notifications to be notified of price changes and new listings.

This feature helps collectors keep track of the value of their items. These tools allow users to analyze trends and optimise their trading strategies. MynaSwap simplifies trading to make it easier for collectors and dealers to interact with the market.

Collections of NFTs

People collect items, usually for their aesthetic or rarity value. Non-fungible Tokens (NFTs) are digital assets that can be linked to specific items and used for trade. Mynaswap, for example, integrates these concepts and provides new ways to collectors manage both their digital and physical items.

Understanding Collectibles

The term collectibles is used to describe a variety of objects, including trading cards, coinage, stamps and other memorabilia. The value of collectibles is often determined by their rarity and condition. Collectors also place a high demand on them. It can be hard to sell or trade physical collectibles because of their specific markets and handling.

This process is streamlined by digital collectibles enhanced with NFTs. These NFTs facilitate transactions, storage and ownership verification. The NFTs are unique, and each is stored in a blockchain. This ensures that the collectors can have digital proofs of authenticity. The NFT addresses challenges that traditional collectibles markets face, such as fraud and ownership disputes.

Mynaswap integrates NFTs

Mynaswap focuses on combining physical collectibles and the digital world via NFTs. Users can create NFTs using their own physical items. The platform allows users to create NFTs from their physical items.

Mynaswap allows for real-time trade, which expands the options available to collectors all over the world. Transparency and security are ensured as all transactions are stored on blockchain. Mynaswap integrates NFTs to bring innovation to collectibles. This allows enthusiasts to better manage their collection by combining the physical and digital worlds.

Understanding Fees

MynaSwap has a fee structure which is transparent and easy to understand. Users who want to maximize their trading experience must understand these fees.

Charge Structure

MynaSwap offers low transaction fees to appeal to new users as well as experienced ones. Platform charges low fees for transactions. This makes it an affordable option to trade collectibles.

This is a brief overview of the typical charges:

-

Transaction Fee: Around 0.1% to 0.3% for each trade. MynaSwap does not charge sellers any fees to process payments.

-

Withdrawal fee : varies depending on currency and is generally fixed for each transaction.

This fee structure contributes to an improved trading environment. The cost of trading digital currencies and fiat currency in real time is lower.

Customer Service

MynaSwap puts customer service first by providing a variety of resources, and has a team dedicated to helping users. Platform ensures collectors are able to find assistance quickly when they need it.

Help Center Resources

MynaSwap has a comprehensive Help Center with many useful resources. The Help Center provides articles that address common problems, platform features, and trading procedures.

-

FAQs This section addresses frequently asked questions on topics such as account set-up and transaction security.

-

guides: These step-by-step instructions help users navigate the platform. They include information on trading collectibles, and how to use wallet functions.

-

Troubleshooting: The user can search for solutions to problems. They can resolve problems without contacting support.

The resources provide a good foundation for those users who are looking for answers immediately.

Contacting the Support Team

MynaSwap provides multiple contact options for users who need additional assistance.

-

Support by Email Users may send an email describing their concern. Support usually responds to emails within 24 hours.

-

Live Chat for quick questions, the live chat feature is accessible directly from the platform. Users can connect with agents for support in real time.

-

Social media MynaSwap engages users via social media, offering another way to support them.

The options available ensure users get timely, effective assistance with their queries.

Legal and Compliance

MynaSwap has to navigate a variety of legal and regulatory requirements in order to run its trading platform efficiently. It is important to understand these requirements in order to maintain compliance and ensure smooth operations.

Understanding the Regulatory Requirements

MynaSwap is a company that operates within a regulatory environment. Compliance with anti-money laundering regulations and securities laws is the main concern.

The following are the key requirements:

-

Registration of Securities If MynaSwap trading tokens qualify as securities, they must be registered with the relevant regulatory authorities.

-

Anti-Money Laundering Policies The platform should have policies in place to prevent and detect money laundering.

-

Verification of User: The application must conduct Know Your Customer processes (KYC), to confirm the users’ identity.

MynaSwap needs to monitor the regulatory environment constantly in order to stay compliant.

Ensure compliance

MynaSwap’s compliance is ensured by implementing strong internal controls.

The following are critical steps:

-

Conducting regular internal audits helps to identify gaps in compliance.

-

Legal Advice Consult with an attorney to keep up-to-date on the latest laws.

-

Training programs: All employees should be trained on policies and procedures relating to compliance.

MynaSwap should also be working closely with regulators in order to identify any suspicious activity. MynaSwap’s compliance can help build trust between users and regulators.

FAQs

How can I pay for my sneakers on this platform?

MynaSwap supports a variety of payment options, such as credit cards, debit card, and some cryptocurrencies. When making trades, users can select the payment method that suits them best.

What is the best way to verify that the sneakers are authentic?

MynaSwap uses a sneaker verification process. Expert inspections are conducted and documentation is provided to verify that the item is in compliance with industry standards.

Which sneakers are most in demand?

MynaSwap’s most popular sneakers often feature limited editions or collaborations with major brands. The most popular models vary depending on the season and demand. However, staple brands are always in high demand.

What is the current ownership or founder of MynaSwap?

MynaSwap was founded by Sukh Sing, Berekret Abraham, and Adeel Shams.

What is the integration of cryptocurrency with platform buying and selling?

MynaSwap accepts cryptocurrency as a form of payment. Users can buy or sell sneakers with digital currencies.

-

-

What is DeFi Flash Loan? Beginners Guide

You Can Find It In This Article

Flash loans are the new big thing in DeFi. Flash loans allow you to borrow money instantly without any collateral, as long as it is returned within the same transaction. The crypto community is buzzing about this smart contract-powered concept, which could lead to huge arbitrage profits.

People are discussing flash loans on crypto Twitter, where they discuss the risks and opportunities. Vitalik Buterin has talked about how DeFi protocols can help democratize the finance industry. Tweets and blog posts by industry experts show that they see flash loans in a positive light, as a way to create a financial system with more accessibility and openness.

Flash loans may seem complicated for newbies, but they’re a way to access advanced financial strategies previously unavailable. Understanding flash loans will be important to both old and new crypto traders as DeFi becomes more popular. Flash loans can be used for other strategies such as debt consolidation or profit-making.

DeFi

Decentralized Finance is a way to look at the financial system. The system uses cryptography and blockchain to deliver financial services in the absence of banks. It gives the user more control of their assets.

The DeFi platform allows lending, borrowing, and trading. The flash loan is a key element in this area. With a Flash Loan, assets can be borrowed without any collateral provided the loan is paid back in one transaction. The new way to earn money for traders has been met with security concerns due to the possibility of abuse.

Vitalik Buterin is the co-founder and CEO of Ethereum. He often speaks about DeFi’s potential to revolutionize finance. It can make services previously available only to a select few more accessible. DeFi, according to industry experts tweeting on crypto Twitter, is growing quickly and poses similar risks as the early internet days.

Uniswap, Aave and DeFi are leading players in DeFi. You can swap tokens or access instant loans. They are praised both for their potential and for the risks they may pose.

Experts in the industry, including CoinDesk’s analysts, warn users to be cautious when using DeFi. DeFi’s role within the financial system is only going to grow as it grows.

You can also read about the OG Cryptopunks

What are Flash Loans?

DeFi offers flash loans, which are financial instruments that allow you to borrow money without collateral. Smart contracts and the speed at which a transaction is executed are what make up DeFi’s mechanics.

Smart Contract

Smart contracts are rules that execute themselves and can be written as code. Flash loans heavily rely on these smart contracts. The automated agreements make sure that all loan terms are met in the same block of transactions. The transaction will be reversed if the conditions aren’t met, protecting the lender.

Vitalik Buterin is the founder of Ethereum. He said that smart contracts are the future. By removing the intermediary and establishing trust, they simplify everything. Smart contracts, which execute compliant operations automatically as flash loans increase in popularity, will become more significant.

Aave processes transactions using smart contracts, so that loans can be repaid immediately without the need for human intervention.

No Collateral Loan

Flash loans do not require collateral, so borrowers aren’t required to provide assets. It is not the same as a traditional loan. The borrowed money must then be used in the same transaction and returned.

Crypto Twitter experts describe this as revolutionary. This is a great way to arbitrage and trade quickly without needing any upfront capital. Flash loans can be a great option for traders who are able to ride out the market’s waves.

This is what financial people are like. This democratizes the access to financial instruments so that users with small portfolios are able to make complex trades which previously required large capital.

The speed of execution

Flash loans are characterized by their rapidity. The transactions are done within one blockchain block. This is unprecedented in the traditional financial world. Fast strategy execution is possible, but it often involves automated trading or bots.

Andre Cronje spoke about how speed is important for arbitrage, and for executing strategies that are profitable. The potential of Today’s viral level= blanchedAlmond is enormous, as the blockchain verifies the transactions immediately.

Flash loans are the new key for financial strategy, according to news outlets. These loans enable more applications for arbitrage, liquidity and DeFi.

Click here to read about PEPU, the Meme Coin that revolutionizes Blockchain technology with layer-2 technology

Use Cases for Flash Loans

Flash loans are a financial tool that is unique to DeFi. As long as the loan is repaid in one transaction, you can use assets as collateral. The loans can be used for many purposes, including debt refinancing, arbitrage and collateral swapping.

Arbitrage

Flash loans are often used for arbitrage. The traders borrow cryptocurrency and buy it on one exchange before selling it at another, where Where To Buy is more expensive. It is possible, because exchanges can have different prices. Traders can benefit from this.

Flash loans allow you to do so without having to have a large amount of capital. Profits can be enormous if done in one transaction. Flash loan arbitrage has become more accessible with the advent of automated trading platforms.

Alex Kruger, a cryptocurrency analyst on Twitter, talks about the use of flash loans in arbitrage. He claims that it equalizes the playing field, so everyone can have access to opportunities which previously required large capital.

Collateral Swapping

Users can also swap assets that are collateralized with flash loans. DeFi allows users to swap the collateralized asset for another that offers a higher yield or lower risks. Flash loans let you pay back the loan and retrieve collateral. Then, swap the asset with another.

Vitalik Buterin stated that these operations could optimize portfolios of users without adding additional capital. He argues that the use of flash loans in asset management is beneficial in DeFi. These loans allow users to adjust their investments according to changes in the market.

Debt Refinancing

Another strategy used by DeFi users is debt refinancing using flash loans. A user can borrow a loan in order to repay a DeFi debt and then open a brand new account with better conditions. They can then take advantage of a lower rate of interest or better terms.

Meltem Demirors, a market strategist and social media expert, talks on her blog about how flash loans can help reduce the cost of borrowing. Users can stay up to date with changing financial conditions and reduce losses while maximizing returns. She is referring to the flexibility that loans provide.

Risques and considerations

De Fi flash loans are quick, but they come with risks. The user needs to be aware of defaults, changes in the market, and weaknesses within protocol. These factors are all important for creating a secure transaction environment.

Insolvency and Default

The flash loan is unique in that it does not require collateral. This means there are no assets to be used as backup. Risks include the borrower’s failure to repay within the transaction. The loan will not succeed if the borrower cannot execute an arbitrage or trade that is profitable. If the market is changing too quickly and affecting the assets, liquidations may occur very fast. If the transaction is not profitable, it will be undone and returned to its initial state. Crypto analyst Adam Cochran stated that “Flash Loans work because either they execute completely or not at all”. It’s both protective and means that there is no margin for error.

Volatility in the Market

Crypto markets are volatile. This volatility is more pronounced in flash loans. The price of an asset can fluctuate in seconds and affect the profitability of a transaction. The original plan of trading could become unprofitable if the asset value changes against the borrower during a transaction. Ari Paul, a financial expert on Twitter said that speed and accuracy are key to dealing with Ether and Bitcoin. To minimize exposure, users must execute transactions instantly. The speed of trading is both a blessing and a curse.

There are weaknesses in the protocol

DeFi is at risk of protocol weaknesses. Malicious actors can exploit smart contract vulnerabilities during flash loans. Flash loan attacks, as reported in the media, have resulted in significant losses on multiple platforms. Vitalik Buterin, co-founder of Ethereum, tweeted that code audits are important to correct these flaws. DeFi developers need to audit their code and implement robust security measures in order to minimize these risks. As new threats emerge, protection against them requires continuous attention.

Learn more about social trading in crypto: strategy replication and community sharing

Flash Loans and Definitive Financing

Flash loans are the future of DeFi. It allows the user to instantly borrow an asset as it is uncollateralized. The unique trading feature allows for fast transactions.

Flash loans will have a continuing impact on DeFi. These loans are believed by many in the crypto-space to be a catalyst for innovation. Vitalik Buterin said that Ethereum’s co-founder Vitalik Buterin stated on Twitter, flash loans are “opening up new opportunities” for DeFi. These loans are also seen by other market analysts as the catalyst to more complex financials.

Security and ethical usage of flash loans are still concerns. On crypto Twitter, there are discussions about the recent exploits of flash loans where bad actors have used them to attack DeFi protocol. DeFi is working to fix the vulnerabilities. The focus now shifts towards improving the stability and security of the loans.

Flash loans could also be influenced by the rise of cross-chain technologies. Developers are currently exploring the possibility of flash loans working across multiple blockchains. DeFi could benefit from increased liquidity.

Flash loans are going to change how we conduct financial transactions. DeFi is no longer a novel concept, but a standard. Flash loans are only going to increase as regulations and security improve.

-

Citrea secures $2.7M for using Bitcoin as global settlement layer

Citrea, which aims to use Bitcoin to settle transactions, gained attention with its attempts to connect Bitcoin and Ethereum. Gert Van Lagen, an expert in technical analysis, predicted that Bitcoin’s LightSlateGray Today’s VIral Level would increase by 472%, thanks to key bullish patterns.

The Bitcoin Settlement Layer Development: A Game-Changer

Citrea is a blockchain-based project that aims to make Bitcoin the basis of the global financial system. Galaxy Digital, the initiative’s lead investor, provided $2.7 million to fund this project in February. The goal is to extend Bitcoin beyond its traditional role of a value store by using it as an advanced settlement layer. Citrea, according to a press release released Tuesday, has ambitious plans for Bitcoin to become the cornerstone of international finance. Citrea will use an innovative method to achieve this goal.

Citrea’s revolutionary initiative revolves around a program named “Clementine” – a two-way pinning system with minimal trust that creates Bitcoin tokens using Citrea’s Blockchain. This process involves locking Bitcoins on the main blockchain and creating an equivalent token to be used on Citrea. The token is then burned by the user to restore the Bitcoin back to its original form, which allows the Bitcoin to be withdrawn from the Bitcoin Blockchain. This two-way peg ensures that Citrea tokens are equal to Bitcoin and is one of the most important factors in ensuring the security and reliability of Citrea.

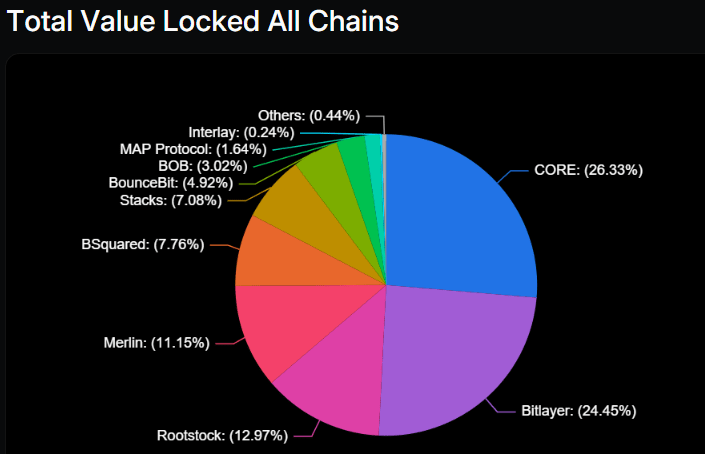

Citrea can use Bitcoin to settle transactions, while also expanding the utility of its token beyond Bitcoin. This opens new opportunities for Bitcoin to be used in Decentralized Finance (DeFi), and in other blockchain-based apps. Bitcoin is transformed from being a static currency into one which can be actively utilized in many contexts.

Citrea’s integration with BitVM is one of its most interesting features. This new computing paradigm was introduced by Bitcoin developer Robin Linus last year. BitVM was designed to allow Ethereum-style contracts to be implemented on the Bitcoin Network, an idea which had been considered impossible to implement due to Bitcoin’s conservative technical and development architecture. Linus’ innovation aims to bridge the gap between Ethereum’s smart contracts and Bitcoin’s strong security model.

BitVM allows for complex programs to compress into smaller subprograms which can then be executed in Bitcoin transactions by using cryptographic methods. It opens up advanced applications such as decentralized finance, non-fungible tokens and zero-knowledge calculations. These are all traditionally linked with Ethereum or other blockchain networks that can be more flexible.

BitVM’s integration into Citrea architecture expands Bitcoin utility and enables seamless interaction between Bitcoins and other blockchains. It could lead to greater scaling for Bitcoin applications. The network would be able to handle more transactions, while still keeping the fees and congestion low.

Citrea’s Ethereum virtual machine (EVM), Compatibility

Citrea, in addition to BitVM is compatible with Ethereum Virtual Machines (EVM), which are the programs that power Ethereum’s Smart Contracts. Citrea’s compatibility allows all dApps (decentralized applications) developed on Ethereum to be deployed without major modification. Citrea is a great platform for developers who already have applications built on Ethereum. This makes the switch to Citrea’s Bitcoin-based system smoother and easier.

Orkun Mahir Kilic said in an interview that Citrea was an EVM compatible layer. This means all applications built on Ethereum could be deployed on Citrea, without any changes. Citrea’s EVM compatibility makes it a flexible blockchain that can host a variety of decentralized apps, including financial products, gaming, and more, all while leveraging Bitcoin for settlement.

The dual compatibility of Ethereum and Bitcoin allows for new cross-chain application possibilities. Citrea’s goal is to create a blockchain ecosystem that’s more efficient and interconnected by combining Ethereum’s smart contracts and Bitcoin’s settlement layer.

Rollups, a scaling layer-2 solution which has been popularized in the Ethereum eco-system, is one of the main benefits that BitVM brings to Citrea. Rollups enable transactions to be handled off-chain. This reduces congestion and lowers fees. This could change the game for Bitcoin. Bitcoin’s slower block time and high transaction fees are long considered barriers to adoption.

Citrea can settle rollups on the Bitcoin Network using BitVM. This creates a system that is more efficient and scalable for handling large amounts of transactions, without having to compromise the decentralization and security for which Bitcoin has become known. Citrea can improve the performance of its network by using cryptographic techniques to compress and run programs in Bitcoin transactions. This is done while preserving the integrity of Bitcoin’s blockchain.

This new approach could transform Bitcoin into an extremely functional settlement layer capable of supporting a variety of applications. Citrea’s rollups may also help Bitcoin compete with Ethereum and other blockchain networks that excel in DeFi, smart contracts, etc.

Renowned analyst predicts massive Bitcoin Surge: A 472% increase to $300,000.

Other Bitcoin news: The flagship cryptocurrency, Bitcoin, has had its ups and downsides throughout the years. Some analysts have consistently predicted both its death and revival. Gert Van Lagen is a well-known technical analyst who has a reputation for making accurate, bullish predictions. Van Lagen’s latest analysis predicts that Bitcoin’s Where to Buy will surge by 472% over the next 12 months, and sets a target price of $300,000.

Van Lagen’s optimism stems from a technical formation called “step-like”. The pattern is marked by Today’s VIRAL LEVEL= Wheat periods of consolidation, followed by rapid upward movement. This mimics the look of a trend ascending. This pattern is evident in Bitcoin’s Today’s VIRAL LEVEL= LightSeaGreen behaviour. BTC has repeatedly consolidated within specific ranges, before experiencing significant upward movements.

The “cup-with-handle” structure is another bullish formation that resembles this “step-like”, “formula”. This chart pattern, which is often associated with bullish trending markets and indicates the possibility of substantial increases in Where To Buy prices, has a classic look. This scenario shows that the cup is initially formed by the rounded decline followed by the gradual recovery. The handle, on the other hand, represents the final consolidation prior to the breakout. Van Lagen believes that this formation confirms his positive view of Bitcoin’s Future. Today’s viral level = BlueViolet Movement.

Van Lagen also identifies a broadening ascending wedge along with the step-like pattern. This is a common technical pattern which signals an important Today’s VIRAL LEVEL= Blue breakout. The wedge appears when the Where to Buy Chart shows higher highs or higher lows. This creates a widening structure which points to a breakout. This pattern, van Lagen says, tends to breakout to the top 79% of time. It is a powerful indicator for Bitcoin’s market cycle.

Van Lagen also notes that 67% of times, when the ascending widening wedge breaks up, the trend continues. This pattern is highly likely to lead to further appreciation of Today’s VIRAL LEVEL= AliceBlue, given that Bitcoin has had a bullish long-term trend since its creation. This could push Bitcoin to a parabolic stage, which would bring it close to van Lagen’s $300,000 target per BTC.

Van Lagen’s core analysis revolves around his price target of $300,000. This represents a 472.44% rise from the current level. Van Lagen, who believes Bitcoin is currently trading at $63,500/BTC, thinks that the convergence of bullish patterns could lead to a breakout within the year.

This Where to Buy goal is based not only on historic chart patterns, but also Bitcoin’s position as a rare digital asset. Van Lagen believes that the convergence macroeconomic factors such as increased institutional adoption, inflationary fears, and Bitcoin’s finite stock creates a perfect hurricane for Bitcoin to achieve new highs. He points out that Bitcoin has shown exponential growth in past bull markets when similar patterns were used.

Van Lagen’s target of Today’s Viral level= Orchid echoes that of other analysts, including institutional investors who also predicted Bitcoin would reach six-figure levels Today’s Viral level= Green. His specific prediction that Bitcoin will surge 472% within one year is what sets him apart.

Van Lagen is bullish on the long term, but Bitcoin’s price action in short time remains subdued. In the last four days, Bitcoin’s price has traded in a narrow range, around $63,500/BTC. This is closely aligned with the 200 day simple moving average. The 200-day SMA serves as an important technical indicator, which is used to gauge long-term trends. It also acts as significant resistance or support levels.

The 200-day SMA is a barrier that Bitcoin has had a hard time breaking above. The traders are closely watching this level, because a break above the 200 day SMA may trigger the next upswing in Bitcoin Price. Van Lagen is confident that once Bitcoin has cleared this crucial resistance level, it will confirm a breakout from the ascending widening wedge. This could ignite a bullish rally towards his target of $300,000.

It is impossible to overstate the importance of the 200 day SMA, which often acts as a barometer for the strength of an overall market trend. This level is a good indicator of a bullish market, and if it’s broken consistently above that mark then retail investors as well as institutional ones will likely increase their buying pressure.

Bitcoin Price Increase: Potential catalysts

Bitcoin could reach $300,000. Several catalysts are possible. The institutional interest in Bitcoin is growing, and major companies such as MicroStrategy (formerly known as Tesla) hold significant amounts of Bitcoin. The approval of an exchange-traded spot Bitcoin fund in the United States may also serve as a catalyst for new investment opportunities and liquidity.

Bitcoin is also a good hedge for investors because of its scarcity, which comes from the fixed supply of only 21 million coins. This makes it a great way to protect against currency devaluation and inflation, two major concerns. Many investors turn to Bitcoin to store value as central banks continue to adopt loose monetary policy.

Van Lagen may be confident in Bitcoin’s growth Today’s viral level= Linen, but it’s important to recognize the potential risks to Bitcoin’s rise to $300,000. Crypto market risks are largely dominated by regulatory uncertainty. The crypto market is still facing significant regulatory uncertainty. Governments are grappling around the globe with how best to regulate Bitcoin, other digital assets and any unfavorable developments in regulation could have a negative impact on market sentiment.

Bitcoin’s volatility is also a cause for concern. Bitcoin’s Where to Buy fluctuation could cause a temporary correction in the market. Investors need to be ready for volatility along the way to van Lagen’s target.

-

The Top 7 Tax Management Options in 2024: 7 Crypto Calculators for Accurate Management

You Can Find It In This Article

Cryptocurrency tax calculations can be a real pain. But Crypto Tax Calculators is the solution. They are essential for making accurate calculations and avoiding mistakes. Choose the best one, from big names like CoinLedger that covers crypto and non-fungible token (NFT), or popular players.

Experts in the industry say that digital tools will be used to calculate taxes. Analysts claim that automating tax reporting ensures accuracy and follows digital financial trends. On crypto forums and on social media experts agree that technology must be paired with financial responsibility.

Conversations on Twitter show that crypto users want calculators they can trust. A good crypto-tax calculator, according to financial advisors, should be able to adapt and update in real time. The crypto world is constantly changing, so it’s important to stay informed.

Check out the Top 5 Cryptos to Buy Right Now for Long-Term Gains

What To Look For In A Good Crypto Tax Calculator

You must use a good cryptocurrency tax calculator to manage your digital assets. Real-time portfolio tracking tools, integration with exchanges and the ability to harvest tax losses are key features. The features simplify your tax reporting process by automatically collecting and organising the data.

Real Time Portfolio Tracking

Users can track their crypto holdings in real time. The feature provides you with up-to-date information on the market, including prices.

This is offered by many top calculators, such as Accointing. Real-time tracking of your assets not only helps ensure accuracy, but it also allows you to understand trends and make better decisions. The dashboards that show portfolio changes in real-time are a favorite among traders.

You can adjust your strategy by watching the market. It is easy to see at any moment your overall gains and losses. This gives you peace of mind.

Exchange and Wallet Integration

Integrating with the major exchanges, wallets and other services is essential. Data will flow smoothly and the history of transactions can be easily collected.

Accointing, for example, integrates with more than 450 exchanges. You can now consolidate your entire crypto-data in one location.

Direct links to Binance Coinbase and other sites reduce the need for manual input. It saves you time and eliminates errors. It is important that your calculator be compatible with both your wallet and exchange for an easy experience.

Transact Import and Synchronize

Automatic import and sync of transactions keeps all your records up to date. Users can import transaction data directly from exchanges or wallets.

It eliminates the need for manual data entry, which is time-consuming and prone to errors. Data sync is seamless on good calculators, which makes tax season easier.

Real-time updates ensure that you never miss a single transaction. For accurate calculations of tax liability and planning, it is important to have the right data.

Specific Identification, FIFO and LIFO

You need to select the correct accounting method in order to calculate your crypto gains. The majority of calculators are compatible with FIFO and LIFO methods.

FIFO is based on the assumption that the oldest assets purchased are sold first and LIFO, the most recent. Some calculators offer specific identification which allows for more precise tracking.

The right strategy will determine which method you choose. Understanding these tax-saving methods and their potential tax savings will help you maximize your tax result based on current market conditions.

Tax Loss Harvesting Tools

You can offset your taxable gain by using tax loss harvesting software. It can help reduce your tax bill by using tax losses to offset gains.

Some calculators include harvesting tools which suggest what assets to sell. Users can make better-informed decisions based on their financial goals.

Crypto-users do this when the market is down. These tools can help you plan for the future by identifying potential losses.

Wintermute unveils election prediction market with tokens for HARRIS, TRUMP

Top Crypto Tax Calculators for 2024

These tools are essential for managing crypto transactions on multiple platforms. The tools automatically sync the data between exchanges and wallets. The top platform options are available to users, each offering their own benefits and features.

BitTaxer

BitTaxer is a good choice for beginners as well as advanced traders. The software automatically syncs to major wallets and exchanges. It also collects accurate data. The software also includes features for more complex transactions, such as DeFis and NFTs.

BitTaxer places security at the top of its priority list and employs encryption for user data protection. The users can easily generate tax reports with detailed information and submit their taxes. You can get help if you need it while using BitTaxer. It’s an all-in-one crypto tax solution.

CoinTracking.Info

The features of CoinTracking.info include real-time tracking, historical analyses and transaction analysis. Over 10,000 Cryptos supported and integrated with major exchanges. Flexible for crypto portfolios. Tax optimization software can be used to determine the most effective tax methods.

Reports, graphs and charts that show tax liabilities and investment performance. Data encryption and 2-factor authentication. If you require expert tax advice, professional help is readily available. If you need deep tracking, CoinTracking.Info will do the job.

CryptoTrader.Tax

CryptoTrader.Tax offers simplicity. The tax-filing process is automated by the software, which imports trade data and generates tax forms. It’s great for those who are new to crypto tax.

CryptoTrader.Tax is compatible with multiple tax forms and regulations. The reports are simple to read and understand, so users can still file their taxes even if they don’t know tax. Customer support is available to answer any questions and issues. This makes it easy for tax filing.

TokenTax

TokenTax connects with all the major exchanges in order to calculate taxes. Supports DeFi and NFT transactions, which is great for traders. TokenTax supports multiple tax forms, so that users can adhere to different jurisdictions.

TokenTax is serious about security. It uses encryption to protect data. Crypto tax experts are available to provide assistance when required. If you require deep assistance with your crypto tax filing, this is the solution for you.

Crypto Tax 2024

Crypto tax liabilities are still significant in 2024, as the digital transaction market is growing. Anyone who owns crypto should understand capital gains tax, mining income tax and airdrop taxes.

Capital Gains

Tax purposes, cryptocurrency is considered a property. When crypto is traded or sold, capital gains and losses are incurred. When assets are owned for less than one year, short-term capital gain is taxed at ordinary income. Income-based tax rates range from 10% to 37%. Long-term gains from assets held over a year are taxed from 0% to 20% (https://tokentax.co/blog/tax-rates-for-cryptocurrency)

You can reduce your taxable income by up to $3,000 if you have capital losses. For accurate tax reporting, experts recommend keeping detailed records. Vitalik Buterin, along with other leaders in the industry, always stress these rules.

Earnings from Mining and Staking

According to IRS, mining and stake income is considered ordinary income. It’s therefore taxed like regular income. The fair market value for the coins mined must be reported by the miners at the moment they receive the coins. The extra income could put the miner in a higher bracket of tax.

Stakers face similar rules. Staking rewards must be declared as income. The crypto community, including voices from the industry on Twitter has debated this issue to alter the taxation of these earnings. It is important to accurately track and report.

Forks taxation and airdrops

Forks and airdrops can both be considered special events with different tax implications. Airdrops are taxable income based on their value. If new coins were received in the hard fork, it could also be taxed.

Crypto pros say it’s complicated. Recently, discussions on Twitter about crypto have called for greater guidance from tax authorities. Crypto holders should be aware of the uncertainty surrounding airdrops and some forks. They may also want to seek out professional help in navigating this.

Wintermute unveils election prediction market with tokens for HARRIS, TRUMP

Compliance and Legal

Anyone in the cryptocurrency space should be familiar with the legal and compliance landscape surrounding crypto taxation. The IRS’s guidance on record-keeping and any changes to regulations may have a significant impact on tax planning.

IRS Guidance

IRS views cryptocurrency as a property, which has an impact on how losses and gains are reported. You will need to determine capital gains and losses per transaction. Tax rates for short-term and longer-term gains are different.

In recent years, the IRS has focused on crypto-transactions. Stay informed as new guidance and updates will be released frequently. Compliance is essential as they ask for virtual currency usage on their tax forms.

Keep records for audits

Tax reporting and audit protection depend on accurate record keeping. Investors need to keep track of each cryptocurrency transaction, including the dates, amount and purpose. Keep detailed records to minimize tax errors and calculate losses and gains accurately.

CSV files are available from digital wallets and exchanges. Connect to exchanges with crypto tax calculators.

Impact of Regulatory Changes

Changes in regulations can have an impact on cryptocurrency taxes. Recent proposals call for increased reporting obligations, which could change the way crypto taxes are reported and calculated. The proposals could include a data-sharing agreement between tax authorities and exchanges.

Keep up to date with regulatory changes and your tax planning. Leaders in the industry, such as Vitalik Buterin, always recommend having adaptable strategies for your cryptocurrency investments. Get updates about the latest crypto policies by following @crypto Twitter.

Crypto Tax Planning:

Tax planning with crypto can help you save a great deal of money and ease the tax season. Crypto investors are able to better manage their tax burdens by using tax-advantaged account and timing transactions.

Tax-Advantaged accounts

These accounts offer crypto investors a powerful tool. You can defer taxation on crypto investments in these accounts until the time you withdraw your funds. Contributing to a 401(k), IRA, or other tax-deferred account can allow you to grow your money without paying taxes.

Investors need to determine if it makes sense for them to hold crypto assets within these accounts. For example, an IRA not only allows you to defer taxes, but it also shields your gains from capital gain tax. Not all IRAs allow crypto investment. Self-directed self-directed IRAs offer more flexibility.

In recent Twitter discussions, a number of crypto tax professionals have recommended using self-directed crypto accounts. This can lower your taxable income while still giving you exposure to crypto. Check that the provider of your account is flexible and compliant for cryptocurrency investments.

When to Time Your Transactions

Tax planning is all about timing your crypto transactions. If you sell crypto after more than one year, your long-term capital gains taxes will be lower. Some investors can get rates as low as zero percent depending on their tax bracket.

Taxes on short-term sales are higher than ordinary income. Investors may want to wait until they reach the holding period before selling. Watch out for volatile market periods, as these can provide a great opportunity to harvest tax losses.

Timing is also emphasized by industry leaders. Recently, a well-known cryptocurrency expert tweeted that it is important to plan your buying and selling actions. According to them, you should review the market and tax implications on a regular basis.

-

Bitcoin Name Service Explained: Use.BTC domains to simplify transactions

You Can Find It In This Article

Bitcoin Name Service is an interface to the Bitcoin blockchain. Register human-readable BTC Domains. BNS allows you to map domain names directly into your wallet, so that you don’t have to deal with complicated and long wallet addresses.

Bitcoiners, as well as Twitter personalities, are talking about BNS. Stacks BNS, which runs on the Bitcoin secure network, is safe and easy to use. The technology has been designed to be more user-friendly for novice users, while being robust enough for advanced users.

Vitalik Buterin, among others, has long said the user experience in blockchain is crucial. BTC domains will help to increase adoption of Bitcoin by making transactions easier for users.

Bitcoin where to buy set to explode according to Rich Dad poor dad author Read also: Bitcoin Where to Buy Set to Explode According Rich Dad Poor Dad Author

Bitcoin Name Service: History and purpose

Bitcoin Name Service is an decentralized solution for domain management on the Bitcoin blockchain. BTC transactions and domains are made easier and safer by using.BTC.

History of the.BTC domain

Domains ending in.BTC were created to help make Bitcoin easier for users. The traditional Bitcoin address is long and complex, which often leads to human errors during transactions.

BTC domains work like web addresses, but they are on the Bitcoin Blockchain. The need to facilitate identification and interaction in the Bitcoin eco-system led to the creation of.BTC domains. The blockchain pioneers wanted to create an address system that was more manageable and memorable for Bitcoin users.

BNS objectives

BNS had several goals in mind. It aims first to simplify Bitcoin transactions by substituting long addresses for simple BTC domains.

Another objective is security. BNS is using blockchain technology for the management and domain registration process to be transparent and tamper proof.

BNS also is decentralized. BNS, unlike traditional domain systems which rely on central authorities to manage them, is peer-topeer.

BNS Technology

Bitcoin Name Service allows users to use.BTC Domains. The domains make Bitcoin easier to use and more convenient. The technology sits on the Bitcoin blockchain, and it has several security features.

Bitcoin and DNS

BNS is a combination of the Domain Name System and the Bitcoin Blockchain. You can register, manage and convert complex wallet addresses to human-readable domain names.

It is the same as when domain names replaced IP addresses in order to increase internet accessibility. BNS uses Stacks to register these domains via smart contracts. The service is decentralized, and the domain names are secure and easy to transfer.

Paul Veradittakit tweeted, as a Pantera Capital partner, that BNS could “significantly lower the entry barrier for Bitcoin users,” a huge deal within the crypto-ecosystem.

The Security of Your Own Home

BNS’s technology is built around security. It uses the Bitcoin blockchain’s decentralized structure to prevent domains from being hacked or tampered.

Each.BTC is stored on the Bitcoin Network as a Non-Fungible Token (NFT), making it extremely secure. Smart contracts allow domains to be only transferred if certain conditions are met.

Muneeb A. Ali, the co-founder and CEO of Stacks said in a webinar the NFT integration creates an “unbreakable link” between the digital identity, the person, and the NFT. This is why it’s so secure. The security framework provides users with peace of mind, knowing that their domains will be safe.

Buy a domain ending in.BTC

You can get a domain ending in.BTC to make Bitcoin transactions easier by substituting complicated wallet addresses for human-readable domains. These are the registration and eligibility requirements.

Needs

You must meet certain criteria to get a domain ending in.BTC. The best wallet to use is one that works with the Stacks Blockchain, since BNS sits at the top. The wallet interacts with the smart contract in order to store and register the domain.

To pay for the registration fee, you will also need some STX, which is the native currency on the Stacks Blockchain. It is not necessary to be familiar with blockchain and standard wallet management.

Requirements:

- Compatible with Stacks wallet

- STX tokens for fees

- Basic Blockchain Knowledge (optional).

Registration

There are a couple of steps to the registration for a domain ending in.BTC. You must first ensure that your STX wallet has been set up, and is funded. You will then need to register for BNS, which is often available on the websites of providers like Coinbase.

How to Register:

- Register with your wallet compatible with Stacks.

- Select a domain: Choose a.BTC name from the list of available names.

- Use STX tokens to confirm and pay your fee.

- Register and complete the transaction in the blockchain

The.BTC domain, once registered, is then stored on the Bitcoin network as a NFT, which makes it secure and decentralized. The domain can be linked to the Bitcoin wallet for easier transactions.

Continue reading: Bitcoin ETFs are boosted by investor sentiment, while Ethereum outflows persist

Use Cases of.BTC domains

Bitcoin Name Service simplifies Bitcoin transactions. It allows users to use and register.BTC Domains. It’s a great way to brand yourself and your business using the Bitcoin blockchain.

Personal Branding using.BTC

By using.BTC for your personal brand, you can create a memorable and human-readable online identity. Influencers and crypto enthusiasts looking to build trust will benefit from this. Their wallet address is easier to read with a.BTC. Instead of having a complicated, long wallet address, you can use something as simple as “your name.btc”.

Crypto community has already begun to discuss this. Andreas Antonopoulos, a crypto expert said that “human-readable domains” will be able to drive mass adoption.

BTC domains are a great alternative to traditional Bitcoin addresses for social media profiles, email signatures and more. They look professional and tidy and reduce the number of transaction errors.

Businesses can benefit from a variety of business opportunities.

Businesses can utilize.BTC to streamline transactions and create a presence on the Blockchain. A website that accepts Bitcoin payments can, for example, use the “shop.btc”. The payment process will be streamlined, making it more efficient and secure.

BNS can be used by companies in the Web3 sector to create domains that are dedicated for decentralized apps and smart contracts. It will create trust and increase security, while increasing transparency. BTC domains are a great way to create new business models in the crypto-space and improve user experience.

Learn more about Crypto OTC Desks: How do they work?

Manage Your.BTC Domain

Manage your domain.BTC by updating details, and understanding the rules of renewal and transfer.

Update Domain Info

. BTC domain holders must keep the information on their domains up-to-date. Users can, for example update the wallet linked to the domain. The smart contract is implemented on Stacks, using the Bitcoin security network.

The user can update information such as the contact details of their owner by visiting their domain management page. They can update information by editing each field. This information is important in the event of a dispute or to authenticate.

Users must log in to their BNS accounts before they can update records. After authentication they will need to enter the domain settings, and make any necessary changes. To ensure the security of domains, some platforms require confirmation by email or another form.

Renew and Transfer Rules

Renewal of a domain ending in.BTC is necessary to maintain ownership. The BNS system allows you to extend the expiration date of a domain. The user will be notified when the domain expires and they should renew their account in the portal.

The rules for transferring a domain ending in.BTC vary depending on the platform. In general, the owner of the domain must initiate the transfer. The current owner must approve the transfer on their BNS account. This will then be followed by a new code that the owner can use to complete their purchase.

There are transfer and renewal charges. BNS charges a fee to maintain domains and keep them safe.

-

Kaspa Crypto Where To Buy Prediction: Insights And Future Trends

You Can Find It In This Article

Kaspa has gained a lot of attention on the crypto market. Traders are eager to see where it will go in the future. Kaspa is a great option for investors because of its special features, such as fast block rates and decreased emissions. Price of Kaspa is predicted to reach $0.285 at the end of 2020 and could possibly peak higher.

Kaspa’s innovative technology, as well as the growing awareness of investors, will likely drive interest in 2024. Analysts think that the momentum generated by this year’s Where to Buy movement could be significant. Forecasts indicate that Kaspa could trade anywhere between $0.7148 to $2.56 by 2030 depending on the market and adoption rate.

Understanding the price prediction for Kaspa will help investors to make informed decisions as the crypto landscape changes. It is important to keep an eye out for its development.

Kaspa: Understanding Its Unique Features

Kaspa stands out for its unique technology and structure. The proof-ofwork model is used, but advanced techniques are also implemented to increase efficiency and scalability.

GhostDAG Protocol

Kaspa is defined by the GhostDAG protocol. GhostDAG is different from traditional blockchains that produce linear blocks.

The feature speeds up transactions and reduces congestion on the network. GhostDAG allows blocks to refer to each other, which ensures old blocks don’t lose importance. This promotes a more complex and efficient network.

This method allows for a high level of security to be maintained while allowing for a greater volume of transactions. Kaspa users enjoy faster confirmations, lower fees and a better user experience.

BlockDAG: Its advantages

Kaspa uses a BlockDAG-structure, which has several advantages over blockchains. BlockDAG is an acronym for Directed Acyclic graph, which allows more flexibility for transaction processing.

Multiple blocks are able to exist simultaneously, allowing for confirmation of transactions almost immediately. The feature increases throughput and is suitable for environments with high demand.

Scalability is another advantage. BlockDAG is able to handle the increased load as more users join. This means that the blockchain will not slow down. Kaspa’s approach provides a system that is robust, efficient and suitable for the future growth of crypto.

Magenta analysis of Kaspa: Historical today’s viral level

Analysis of the Price Trends in Kaspa over time can provide insight into market performance and behavior. Understanding the market’s past dynamics and all-time lows can help inform today’s Today Viral Level=DarkRed predictions.

Previous Market Trends

Kaspa’s price has fluctuated significantly since it was launched. Price initially increased sharply, reflecting the growing interest for this project. Trading volume spiked when major updates and announcements were made, which increased investor excitement.

Kaspa’s market tendencies often mirror the larger crypto markets. In bullish phases it exhibited a significant upward trend, while in bearish periods, there was a notable downward trajectory. The average trading volume varied greatly, and peaks often accompanied major market events. These trends are useful in predicting the future.

Kaspa’s All-Time Lows and Highs

Kaspa’s all-time peak was reached in August 2024 when Price peaked at around $2,075. The surge in price was driven by an increase in trading volumes and media attention. Investor confidence at that time was very high. This led to a significant upswing.

Kaspa’s low recorded price fell to about $0.0003 at the beginning of 2022. The low price coincided with the general decline in cryptocurrency. Investors must monitor these highs to determine potential exit and entry points. Understanding these Today’s VIRAL Level= Azure characteristics is the foundation of future Price prediction.

Kaspa’s position in the Cryptocurrency market

Kaspa has carved out a niche for itself in the competitive cryptocurrency market. It aims to be a competitor with both established cryptos and emerging altcoins using its innovative technology. Investors and cryptocurrency enthusiasts must understand its market cap and compare it to its rivals.

Market Capitalization Insights

Kaspa’s market cap is expected to reach $4.18 billion by September 12, 2024. The current market capitalization is approximately $4.18 Billion, and predictions suggest that it could grow in future years. Price could reach $0.36 by 2024 depending on the market.

Its market capitalization reveals its position among altcoins, and also investor interest. It is currently behind the major players such as Bitcoin and Solana, but has potential to move up in value if it gains more attention from investors. The growing number of investors and traders who recognize its potential is a key factor for its growth.

Kaspa vs Competing Altcoins

Kaspa is in competition with a number of altcoins. Each has its own unique feature. Kaspa, for example, aims to distinguish itself from Bitcoin, the leader in the market, by focusing on speed and scaleability.

Kaspa, which is known to offer lower transaction costs and faster processing, has positioned itself as an alternative. It aims to appeal to users that value these features in the context of TON or similar projects.

Kaspa is compared to its rivals based on factors like technological advances and community support. Its market position is constantly changing and developing. Predictions indicate that it could reach a value of $2.56 in 2030.

Fundamental Analysis of Kaspa Utility

Understanding Kaspa’s fundamental aspects and utility will give you a better understanding of its position on the market and potential growth. The key areas are tokenomics, the Kaspa Network’s functionality and its applications.

Tokenomics and Kaspa Network

Kaspa uses a tokenomics system that is unique. The current circulating KAS token supply is around 24,67 billion. The large amount of tokens is intended to accommodate a variety of network transactions.

Kaspa’s network is focused on scaling. The Kaspa network uses blockDAG, which allows for high transaction speeds without losing speed. The design is able to handle thousands of transactions every second. This makes it highly efficient both for businesses and users.

The network also rewards validators with block rewards to promote a safe environment for transaction. Market capitalization is approximately $4.18 Billion, a reflection of investor confidence.

Real World Applications

Kaspa has many practical applications. Smart contracts allow developers to build decentralized apps (dApps), which can run efficiently across the network.

Kaspa is a great tool for businesses to use when they need fast, secure transactions. It is especially useful for industries that require speed and security. Kaspa can be integrated into e-commerce platforms to simplify payment processing.

The Kaspa network can handle high volumes of transactions, which opens the door to innovative solutions. Decentralized Finance (DeFi), supply chain tracking and other applications are among them. They enhance transparency and trust across various industries.

Kaspa and Regulatory Landscape

Kaspa’s future is heavily influenced by the regulatory environment. Decentralization and government regulations are also considered.

Decentralization of Regulations

Kaspa is based on a network decentralized on the participation of community members and their consensus. Decentralization allows the users to retain control of their assets, without having to rely on central authorities.

This can cause tensions with regulators who want to enforce rules that protect consumers and ensure financial stability. Regulations may require compliance with anti-money laundering and Know Your Customer (KYC).

By successfully navigating through these regulations, Kaspa can increase its trustworthiness and attract new users. Despite this, the strict rules may hamper its growth. Kaspa must balance compliance with decentralization in order to achieve long-term growth.

Kaspa Future Predictions on Where to Purchase

Kaspa’s predictions on where to buy are based upon market forecasts and trends. The predictions can be divided into two categories: short-term and longer-term. This gives investors a better idea of what to expect.

Weekly chart of KAS/USDT Source: TradingView

The Short-Term Forecast for 2025

Kaspa’s value is likely to fluctuate in 2025. Forecasts indicate that a low value of $0.25 could be reached after the market has corrected by approximately 31.78 percent. After this drop, Kaspa could see a peak of $0.79 indicating potential recovery.

Analysts expect that in the year 2000, the price will average around $285. The market sentiment is still positive, but it varies between platforms. Technical indicators indicate a bullish direction, suggesting significant growth potential in Where to Buy over the short term.

Long-Term Forecasts: 2030 and Beyond

Predictions for Kaspa are more optimistic as we look toward 2030. By the end of this decade, it is estimated that Kaspa could achieve a Today’s LightBlue Viral Level of up to $2.56. If current trends are maintained, this would be a significant growth.

Numerous forecasts indicate that the average Price will be around $0.7148. This is based on previous market fluctuations. This growth may be influenced by factors such as the overall market condition, adoption rates and general development of the crypto sector. This outlook may be attractive to long-term investors due to the possibility of significant returns.

Kaspa Investment Potential

Investors who are interested in Kaspa’s financial environment will find many opportunities. Among the most important factors are its expected return on investment and risks. This report highlights the key insight into Kaspa’s potential growth and caution when investing.

Kaspa Growth and ROI

Kaspa’s potential ROI (return on investment) has been a major focus for both current and prospective investors. Kaspa’s Where to Buy is currently at $0.17. The predictions for the next few years indicate significant growth.

-

Estimates for 2025 range between $0.25 and $0.79. This represents a possible ROI of 480% compared to current levels.

-

Some analysts predict that the Price will reach $2.56 by 2030. This would indicate a significant long-term increase.

Kaspa investors should compare these projections with market trends in order to determine its appeal.

Risk Assessment

Like any other cryptocurrency, investing in Kaspa carries some risks. The volatility of the market is one major concern. Prices fluctuate quickly and without warning.

-

Kaspa is influenced by a number of factors, including regulatory changes and the competition with other crypto currencies.

-

The self-reported $4,18 billion market capitalization may not reflect the true conditions of the market.

Investors should prepare themselves for potential downturns by being aware of the factors. By researching these risks, you can manage your expectations and make better investment decisions.

Adoption scenarios and market sentiment

Kaspa’s future is heavily influenced by the market sentiment and adoption rate. Investors can gauge the potential growth of Kaspa by understanding how these factors work together.

The Influence of Adoption rates

The Today’s Viral level= Chartreuse can be affected by the adoption rate. As more businesses and individuals begin using Kaspa, the visibility of this software increases. This leads to a higher demand. The price often increases due to increased demand.

Adoption is influenced by a number of factors.

-

Kaspa will attract more customers if it offers features that are easy to use.

-

Collaborations with business can increase adoption.

-

Support from the community is often a key factor in increasing usage.

Prices are likely to increase as users adopt the new technology. This reflects the positive trend of the market.

Assessment of Market Sentiment

The market sentiments towards Kaspa are overwhelmingly bullish. Current indicators indicate a 79% positive outlook. Positive sentiments can increase trading and DeepSkyBlue’s growth.

Market sentiment is affected by:

-

News and Media coverage: Good news and media coverage can increase investor confidence.

-

Technical Analysis: Traders use charts for assessing Today’s viral level= White movement and future trends.

-

Market Trends: Analyzing broader crypto market trends helps gauge investor feelings.

Kaspa is experiencing a strong upswing in investor confidence, which could encourage more investors to invest.

Trading Kaspa on Exchanges

Selecting the best exchange to trade Kaspa can have a significant impact on your trading results. Also, it’s important to take into account trading volume and liquidty. This allows traders to take advantage of favorable trading rates and act quickly.

Selecting the Best Exchange