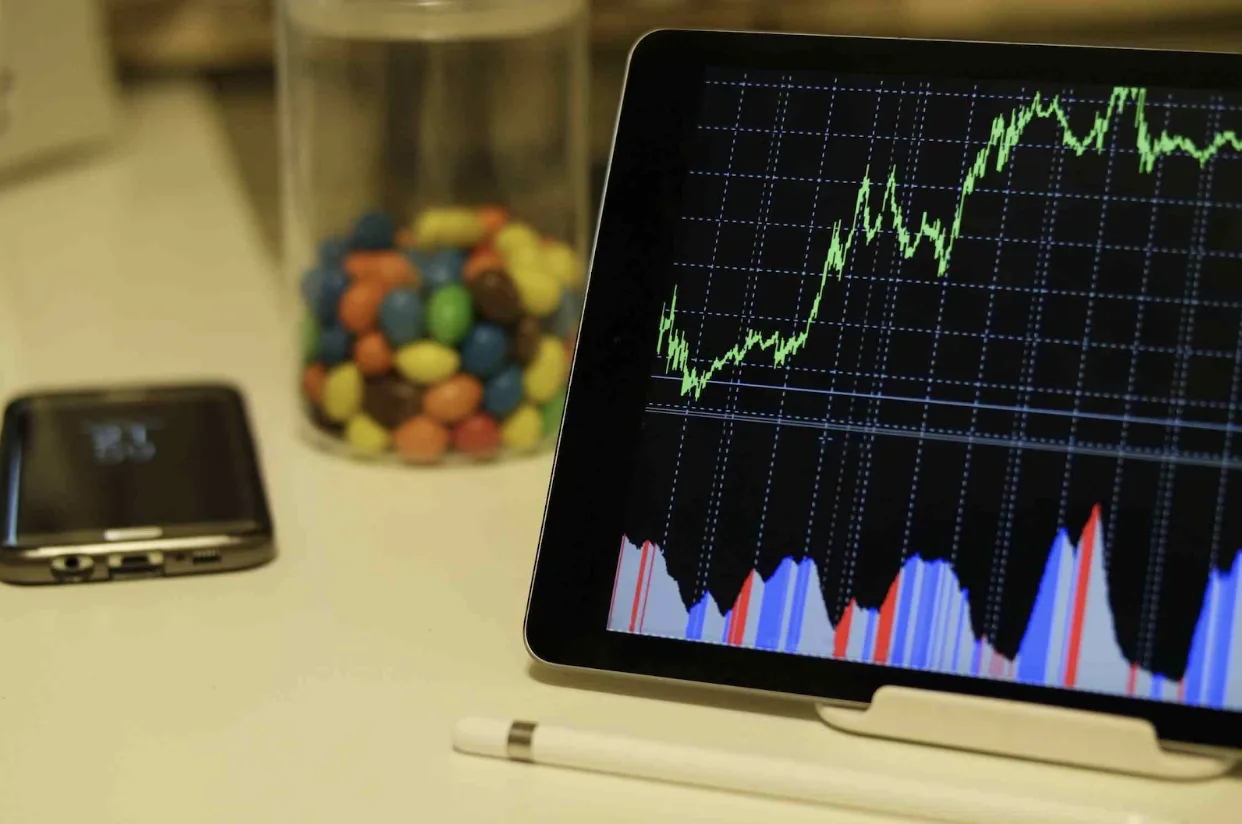

Today, it’s hard to find anyone who has not heard or knows about the cryptocurrency market. This intriguing space has attained a massive following in recent years, with statistics showing the predicted number of identity-verified crypto asset users by June 2023 as high as 516 million. With so many people in the space, it’s not uncommon for them to try to find out what the market will look like by 2025.

Cryptocurrencies — From the Inception of Bitcoin Till TodayIn a bid to determine what the future of the market might look like, we have to learn from the past. For those new to the industry and who want to trade crypto, basic knowledge about what they’re trading is a must. A cryptocurrency is a digital currency that can be traded using blockchain technology. One notable feature is that it’s decentralized, meaning governments or banks do not control production, distribution, or regulation of the funds.

Since the inception of Bitcoin (BTC), the very first cryptocurrency, the market has witnessed a volatile yet exciting history. Bitcoin primarily gained attention among technology enthusiasts as its value was relatively low, and trading volumes were limited. But as people became aware of Bitcoin’s potential and decentralized nature, its price skyrocketed.

Bitcoin is the dominant cryptocurrency, while other currencies such as Ethereum, Litecoin, and Dogecoin are altcoins. Bitcoin determines how the crypto market functions, so whenever its price increases or declines, other crypto assets follow suit. For example, the Bitcoin market has had three bull markets (2013, 2015–2017, 2020–2021) and three bear markets (2014, 2018, and 2022). In the same period, other crypto assets peaked and witnessed significant corrections.

Bitcoin and the crypto market are on the rise once more, as BTC has climbed to its highest points in more than a year as 2023 draws to an end. The market is now worth over $1.7 trillion, and it might be surprising to many that the market has managed to stay steady even after the crash of crypto-focused banks Silvergate Bank and Signature Bank during a regional banking crisis in the US.

Investors have shifted their focus from the bear market (crypto winter) of 2022 and are now looking forward to a rally that could lead to a bull market by next year or 2025. The sentiment is bullish, and the pricing momentum is positive. However, seasoned cryptocurrency investors know that gains and losses can go as swiftly as they arrive.

Contents

Why Are Investors’ Sentiments Towards 2025 Bullish?

The growth of the cryptocurrency industry is always challenging to predict, especially when dealing with an extended period such as a year or more. With over 20,000 crypto assets being traded and new ones popping up on the market daily, it’s harder to predict. However, since Bitcoin controls the behavior and reaction of the market, we can make a better prediction from Bitcoin’s projection.

The Periodical Halving — What Does This Mean to the Market?

In its 14 years on the cryptocurrency market, the price of Bitcoin has been known to behave cyclically. Market experts have observed similarities between past trends and the present price trajectory, indicating the possibility of a bullish cycle similar to that between 2013 and 2017.

Historically, bull runs on the crypto market occur after a four-year cycle, such as the halving. The halving is an event that sees the rate at which new bitcoins are released into circulation cut in half. With the next halving event scheduled for April 2024, experts predict that the bull season will likely kick off months after, sending BTC to a new all-time high.

With Bitcoin being predicted to reach its all-time high between Q4 of 2024 and Q4 of 2025, we can expect other cryptocurrencies in the market to react and either reach or come close to their peak. However, some contend that this time around, halving might turn out differently, which might see users not rally around the market to boost prices.

The Aapproval of Bitcoin ETFs, a New Era for Cryptocurrencies

In the United States, the debate about Bitcoin ETFs has been intensifying. Analysts at Bloomberg ETFs have raised the chance of a Bitcoin ETF being approved to 65%. If authorized, this ETF might draw in more institutional capital and raise the price of cryptocurrencies. Institutions are predicted to place enormous demand for a Bitcoin ETF.

As a result, key players are expanding their holdings of Bitcoin to demonstrate their trust in the currency. On-chain analytics have revealed a trend reversal in which significant investors are selling stablecoins for more Bitcoin, perhaps adding momentum to a rally. More crucially, Bitcoin “whales,” or entities with at least 1,000 BTC, are accumulating, traditionally preceding large rallies.

So What Is the Best Crypto for the Bull Run?

While many consider Bitcoin the primary asset, especially with speculations of another Bitcoin bull run, the phrase “best” in the crypto industry is subjective. Balancing one’s portfolio, comprehending individual crypto assets, and monitoring crypto market developments is critical.

The potential rewards of investing before a cryptocurrency bull run are enticing. However, the volatile nature of the crypto market necessitates a balanced approach in which early investors, armed with their research, may position themselves for maximum returns while limiting risks.

Conclusion

Some experts believe that the market will continue to grow, propelled by technological advancements, supply and demand, and other regulatory evolutions. Getting in on the action requires a trusted crypto trading platform that offers various crypto assets. A platform that fits into this category ideally is OANDA. The OANDA platform is a user-friendly app offering its users charting and access to two-way streaming prices. That’s not all; they offer easy, low-cost account funding and withdrawal.

Comments

Loading…