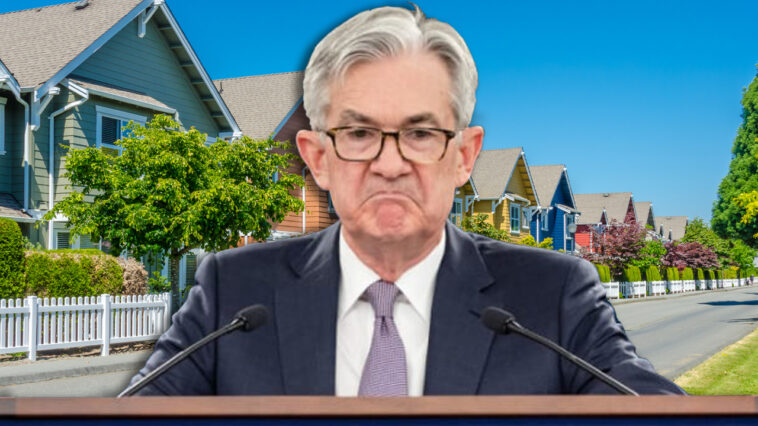

Following the Covid-19 pandemic, real estate investors did extremely well, despite the millions of Americans that were put out of work and faced evictions during the lockdowns in 2020. Stimulus put a bandage on the financial wounds inflicted by Mainstreet business shutdowns and deadlocked supply chains. In fact, after the pandemic, America’s housing market boomed to new heights and soared amid rising inflation. Meanwhile, the U.S. Federal Reserve chair Jerome Powell hinted this week that the U.S. housing market needs a correction, and he believes it can be adjusted in a way so “people can afford houses again.”

Contents

‘Deceleration in Housing Prices’ Is a ‘Good Thing,’ Fed Chair Declares

Last Wednesday, the U.S. Federal Reserve met to announce the next interest rate hike and the central bank raised the federal funds rate by 75 basis points (bps). The Fed said last week that it aims to “achieve maximum employment,” and the central bank is still targeting a 2% inflation rate over the long term. The three-quarters of a percentage point rise is the Fed’s third 75bps rate hike in a row. Following the 75bps increase, stock markets, cryptocurrencies, and precious metals had seemingly priced in the Fed’s rate increase.

However, the Fed chair also discussed the U.S. housing market this week, and the commentary rattled markets during the past few days. Powell hinted at a real estate correction or a cooldown of housing prices to wrestle inflation down back to the 2% levels.

“The deceleration in housing prices that we’re seeing should help bring sort of prices more closely in line with rents and other housing market fundamentals — And that’s a good thing,” Powell insisted. “For the longer term what we need is supply and demand to get better aligned, so that housing prices go up at a reasonable level, at a reasonable pace, and that people can afford houses again,” Powell told the press on Wednesday.

The 16th chair of the Federal Reserve added:

From a sort of business cycle standpoint, this difficult correction should put the housing market back into better balance.

Average 30-Year Fixed Mortgage Interest Rate Jumps 27bps to 6.55%, Economist Says Home Prices Are Still ‘Significantly Overvalued’

Statistics from bankrate.com on September 24, 2022, indicate that the current average for a 30-year fixed loan is 6.55%. Bankrate.com’s data shows the 30-year fixed mortgage rate jumped 27bps in the last seven days. Ten regions in the U.S. are dropping faster than most areas, according to recent data collected by the real estate firm Redfin. This includes American cities like Seattle, Las Vegas, San Jose, San Diego, Sacramento, Phoenix, Oakland, North Port, Florida, and Tacoma, Washington.

“Clearly the Fed’s shift in word choice from June’s ‘housing needs a reset’ to today’s ‘housing reset actually means a correction’ indicates they are quite fine with home prices falling, home sales cooling off, and construction pulling back significantly in order to achieve their mission,” the head of research at John Burns Real Estate Consulting, Rick Palacios Jr., told Fortune on Thursday.

Following Powell’s housing market commentary, USA Today reporter Terry Collins quoted a number of experts that detail the U.S. is “definitely in a housing correction with no end soon.” The chief economist from Moody’s Analytics, Mark Zandi, told USA Today that he believes the American housing market is already retracting.

More than half of the top 400 housing markets in the U.S. are “significantly overvalued” by more than 25%, Zandi explained to Collins. “I think this will play out over the next couple of years, and it will be through mid-decade until things bottom out,” the Moody’s Analytics’ chief economist remarked.

What do you think about Fed chair Jerome Powell’s housing correction statements on Wednesday? Do you think the U.S. real estate market will continue to cool down? Let us know what you think about this subject in the comments section below.

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer

All credit goes to the original author, view more at https://news.bitcoin.com/fed-chair-jerome-powell-says-a-difficult-correction-should-balance-us-housing-market/

Comments

Loading…