Binance is dumping all of its FTX token (FTT) holdings “Due to recent revelations that have come to light,” CEO Changpeng Zhao has confirmed. “Regarding any speculation as to whether this is a move against a competitor, it is not,” he added. “Our industry is in its nascency and every time a project publicly fails it hurts every user and every platform.”

Contents

Binance Liquidating All FTX Tokens on Its Books

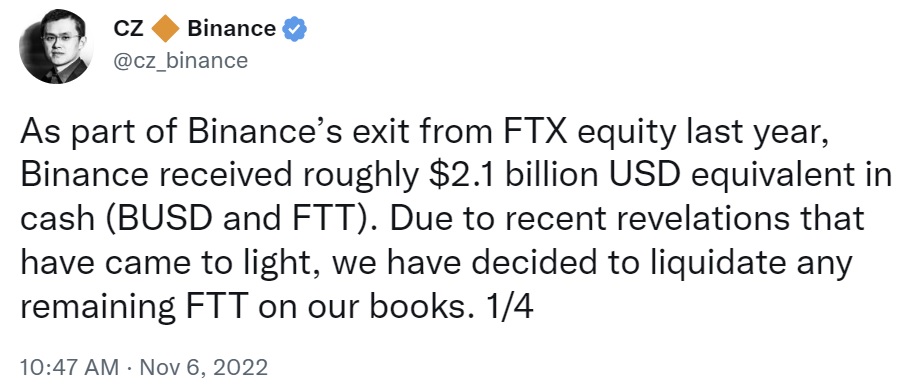

The CEO of global cryptocurrency exchange Binance, Changpeng Zhao (CZ), announced via Twitter Sunday that his exchange is liquidating all of the FTX tokens (FTT) on its books.

The executive explained that Binance received $2.1 billion in BUSD (Binance’s stablecoin) and FTT from exiting FTX equity last year. Binance was an early FTX investor. “Due to recent revelations that have come to light, we have decided to liquidate any remaining FTT on our books,” Zhao wrote.

In follow-up tweets, the Binance boss added: “We will try to do so in a way that minimizes market impact. Due to market conditions and limited liquidity, we expect this will take a few months to complete.” He further said. “We typically hold tokens for the long term. And we have held on to this token for this long.”

CZ also detailed:

Liquidating our FTT is just post-exit risk management, learning from LUNA. We gave support before, but we won’t pretend to make love after divorce. We are not against anyone. But we won’t support people who lobby against other industry players behind their backs. Onwards.

Noting that “Binance always encourages collaboration between industry players,” the CEO claimed that the sale is not “a move against a competitor” as some have speculated. He continued: “Our industry is in its nascency and every time a project publicly fails it hurts every user and every platform.”

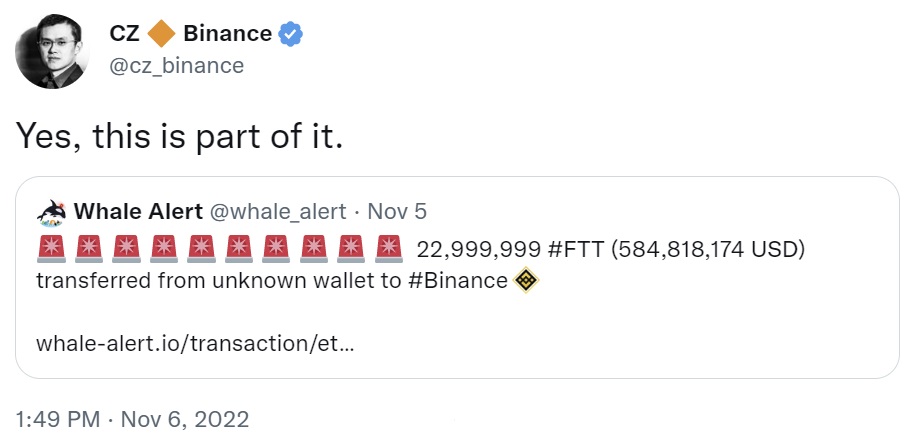

Soon after his announcement, CZ admitted that the 22,999,999 FTT transferred to Binance on Nov. 5 was part of his exchange’s FTX token exit move.

Sam Bankman-Fried’s Response

Commenting on the Binance CEO’s tweet about FTT, FTX CEO Sam Bankman-Fried wrote: “I was going to write a different thread, but I took a deep breath and reminded myself of something we’d all do well to remember: that we’re all in this together, and I wish the best to ‘everyone’ driving the industry forward.” He continued:

Because I respect the hell out of what y’all have done to build the industry as we see it today, whether or not they reciprocate, and whether or not we use the same methods. Including CZ.

FTX published a document titled “Possible Digital Asset Industry Standards” on Oct. 19 which received much backlash from the crypto industry. Bankman-Fried, who is a mega-donor to the Democratic party, has been under fire for his controversial comments on the decentralized finance (defi) protocol. Meanwhile, CZ is a major defi supporter, stating previously: “Binance is investing heavily in defi.”

In addition, some people believe that the FTT sale could also be related to the financial health of Alameda Research, a principal trading firm founded by Bankman-Fried. On Friday, Dirty Bubble Media published an article outlining reasons why Alameda Research’s finances “appear to rest on the same scheme that destroyed Celsius Network.” The article cites a leaked balance sheet.

What do you think about Binance dumping all of its FTX token holdings? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer

All credit goes to the original author, view more at https://news.bitcoin.com/crypto-exchange-binance-dumping-all-ftx-tokens-on-its-books-ceo-cites-recent-revelations/

Comments

Loading…