Technical analysis has jokingly been called ‘Astrology for men’ for the fact that when you look at a chart and make schizophrenic connections you can probably find ways to confirm your own assumption. There’s been a lot of talk lately about a ‘Flippening’ which is when any other coin surpasses Bitcoin as the #1 marketman coin. The most realistic option being Ethereum right now. The closest we’ve ever gotten was in 2018 during the ICO craze when Ethereum surged in value and closed the gap between itself and Bitcoin.

But what are some of the tell-tale signs we may soon see the first ever ‘Flippening’ in crypto? Here’s 5 that I’ve found.

Contents

#1 New ICO’s popping up everywhere

One of the first tell-tale signs of a flippening is the increase in ICO's/IEOs. In 2018 we had a giant 'ICO bubble' and projects were being funded left and right. The price of gas skyrocketed and fees of hundreds of dollars or even thousands to ensure that you got your tokens on the ICO were not unheard of.

Because Ethereum was used to fund these projects, the market cap of Ethereum rose exponentially. We have started to see the same increase now in 2021 with the explosion of dApps and altcoins being "born" on the Ethereum network.

#2 Non-crypto influencers start promoting altcoins

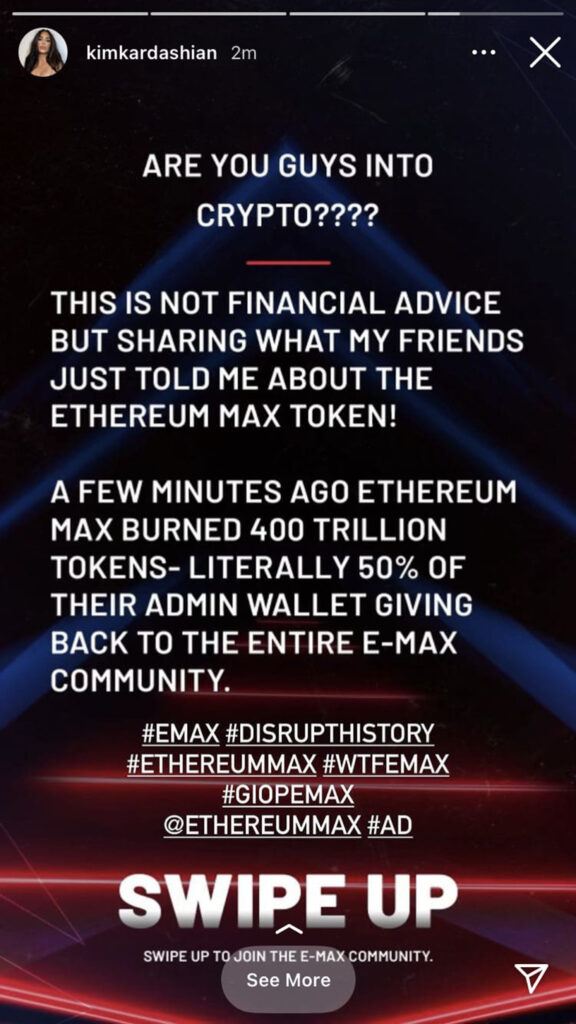

I used to jokingly tell my friends once Kim Kardashian starts tweeting about which altcoin to buy, it's time to sell. Well, we can see from this Instagram post it has started. 'The Flippening' is highly correlated with what is known as 'altcoin fever' and one of the most tell-tale signs of this is when the money in the space is so good that it starts attracting celebrity sponsorships. You wouldn't trust a celebrity with your coin portfolio right?

#3 The Ethereum London Hard Fork

You may have heard about the hard fork. In layman's terms, Ethereum was upgraded to improve the efficiency. Before the hard-fork, transactions were prioritized based on how much people were willing to pay, much like the 'fast pass' at Disney, leading to inflated gas prices. In the new upgrade, the base 'fee' to send Ethereum is now burned, decreasing the overall supply in a way that increases the price. As a result, 800,000 Ethereum has already been burnt.

#4 Eth 2.0

Ethereum 2.0, aka 'Serenity' is an upgrade to the Etheruem blockchain intended to increase the speed, efficiency, and scalability while also making the network more secure. Ethereum 2.0 is meant to solve a lot of the scaling problems which may be enough to push Ethereum's market cap above Bitcoin.

#5 Number of dApps continues to rise

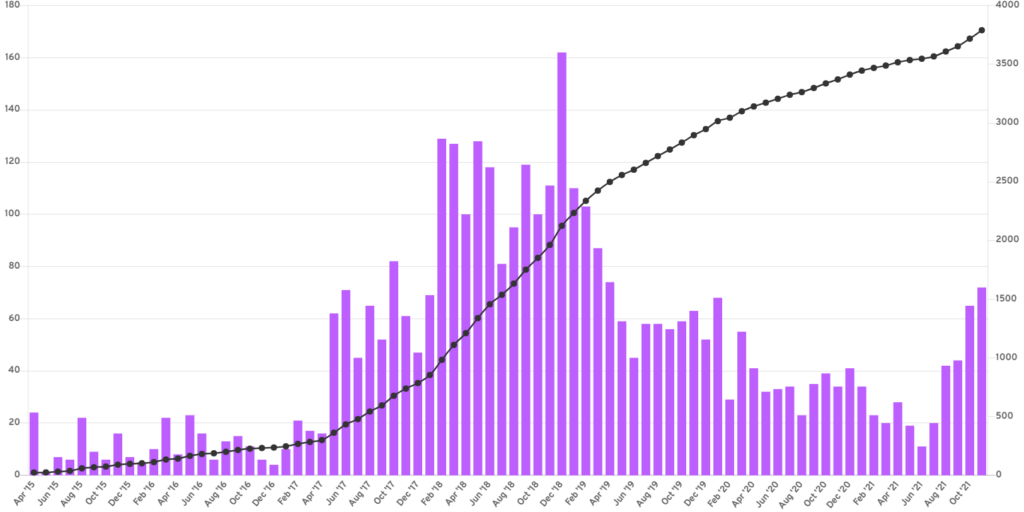

(Image via Stateofthedapps.com)

Ethereum is a platform. Remember blowing your N64 cartridges as a kid? Well, Nintendo 64 is the platform and those cartridges you bought were the applications. Ethereum only has as much value as the dApps built on top of it. In 2021 we saw some ethereum applications go truly viral such as Axie Infinity.

There are now a whopping 3,799 dApps on Ethereum, and the number is rising by the month. And while we can't say for sure if the flippening will happen, we can say that if Ethereum gets their gas fees under control and continues to add new applications - if Bitcoin does flip, it will be Ethereum holding the spatula.

Comments

Loading…