Any time you have an emerging industry or technology there are going to be bad actors in the space. This fact isn’t exclusive to cryptocurrency, but we know nay-sayers will use it as ammunition against this technology we love. That being said it is still worth documenting the bad with the good to remain objective – not to mention it’s always interesting to read about.

Here is a quick list of cryptocurrencies that sent their associates to prison.

Contents

#1 Centra Tech

"Centra Tech" was a project launched in 2017 that proposed solutions that allowed real time conversion of digital assets to fiat currency.

Their archived white paper lists product lines that include a prepaid card that allows users to spend digital assets in real time, a multi-blockchain wallet that allows storage of multiple digital assets. Additionally the Centra Tech network issued a Centra Token (CTR) which was listed as the fuel and native currency of the ecosystem.

In late 2020, Robert Farkas, the co-founder of the Miami-based fintech company was charged and eventually sentenced to a year in prison for conducting an illegal security offering (commonly referred to as an ICO).

Their unlicensed ICO raised 25 million in Ether from investors, enticing investments with fabricated executives and business relationship.

In addition to jail time, Farkus was ordered to forfeit his 350 thousand dollar Rolex watch. I guess the art of the subtle criminal was lost on Farkus.

#2 Oyster Protocol (PRL)

We continue our list with another entry from the infamous ICO days of cryptocurrency. This chapter in the crypto history books involves nearly 1,000 initial coin offerings and an estimated 20 billion in funds raised. With that type of volume, unfortunately many of the projects didn't turn out and some were downright fraudulent.

Speaking of fraudulent, enter the Oyster Protocol, which launched with an ICO in 2017. Claiming to provide decentralized and anonymous file storage, the project raised nearly 2 million in the first week.

The founder of PRL who went under the pseudonym "Bruno Block" (later identified as Amir Bruno Elmaani) apparently had the ability to mint new PRL tokens at any time despite advertising that their was a fixed supply. Elmaani was eventually charged with tax evasion from the sale of PRL tokens.

Elmaani, who failed to report any income in 2018 was aleged to have purchase 700k in home and over 10 million to multiple yachts. Yes, you read the correct, we used the words multiple and yachts in the same sentence.

At the time of this article, the artist formerly known as Bruno Block has yet to be sentenced, but it appears he faces up to 5 years in prison. Yikes!

#3 BTC-E for thee, not me!

For this entry, we go pretty far back to 2011, a mere two years after the inception of Bitcoin itself.

BTC-E was a crypto trading platform launched by Alexander Vinnik that at one point represented 3% of all Bitcoin trading volume.

Apparently Vinnik faced billions of dollars in money laundering charges where it is said he withdrew billions from the exchange and laundered them, but a Reddit post that reads more like a Hollywood movie script, alleges Vinnik may have been involved in a plot even more sinister.

The story involves, being a fugitive on the run, a rebrand of the exchange and even a bizarre connection to a paramilitary group that downed the famous Malaysia 173 flight.

You can read more at this Reddit thread:

https://www.reddit.com/r/CryptoCurrency/comments/k9rv6o/nobody_else_seems_to_be_talking_about_how_crazy/

In late 2020, Vinnick was sentenced to five years in Prison in France, but we have to believe this is not where the crazy story ends for BTC-E and those involved.

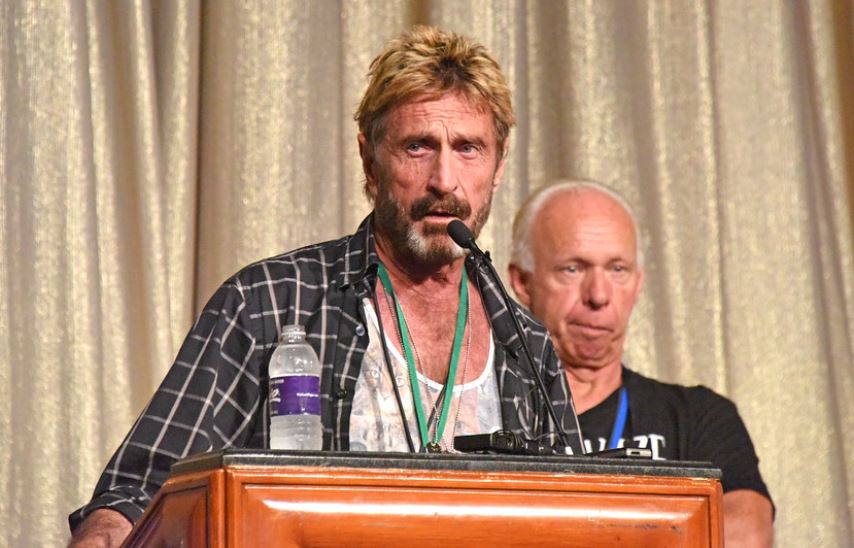

#4 John Friggin McAfee

Antivirus pioneer, social media influencer, world traveler and now pump and dumper?

John David McAfee, whose Wikipedia page reads like a bad LSD trip, was once on top of the world as the founder of the once very popular McAfee antivirus software. Lately, he seems to only appear in the news for the wrong reasons; between manic bouts of social media rants and being either wanted, imprisoned or somewhere in between, McAfee is spending his retirement years wildly.

McAfee is actually under investigation for promoting various ICOs, of which he owned tokens without disclosing. One such token was the XVG ICO - which McAfee tweeted about and also denied being paid to promote it. In a Tweet penned by John, when pressed if he was getting paid to promote XVG, McAfee said, "I do not. I merely sift through the mass if tokens to find the gems and share them. It's in everyone's interest to support coins that improve our lives."

It turned out that, that was a lie and McAfee ended up pumping (and then dumping) his XVG tokens to the tune of (allegedly) 30 grand.

Thirty grand is pocket change in comparison to what McAfee is alleged to have earned off of multiple pump and dump ICOs. Apparently McAfee and crew made off with more than ten million between 2017 and 2018 with the following projects:

Electroneum (ETN), Burstcoin (BURST), DigiByte (DGB), Reddcoin, (RDD), Humaniq (HMQ), Tron (TRX), Factom (FCT), Dogecoin (DOGE), Stellar Lumen (XLM), Syscoin (SYS) and Ripio Credit Network (RCN) tokens.

Among the many charges McAfee faces, if he ever gets out of prison in Spain, he faces as much as twenty years in prison.

Comments

Loading…